26th February 2024

Introduction

Technology-enabled care services in the UK are at a crossroads – driven by the desire to provide a more personalised and wider variety of support to individuals using an ever-expanding range of digital technologies. The intention being to provide increased choice, control, and support for individuals, thus offering them greater independence, whilst also making the best use of increasingly scarce health and care resources.

The main catalyst for change is the digitisation of the UK’s telecommunication networks. This is forcing the move away from legacy ‘single purpose’ analogue platforms that support reactive alarm-focussed services to new versatile and proactive digital alternatives. This shift enables greater opportunities to incorporate the use of technology within people-based care, support and housing services, including a more informed role for family care networks. Data-rich applications will help to continuously assess the changing needs of individuals so that support can be tailored to their circumstances at the point of need. Actionable insights, based on this information, will support proactive intervention by the best-placed source before a situation deteriorates to the point where an alarm is generated. This could be the basis of prevention-based strategies.

There will also be greater opportunities to support self-care or management so that individuals who are able to use technology in their everyday lives can do so to retain or increase their level of independence (because all technology is assistive technology!). The promise of technology-enabled care is that it has the potential to improve the quality of life and wellbeing of people being supported, provide increased reassurance to their loved ones, and offer a better, more efficient use of services.

This shift to digital presents service commissioners and providers with an opportunity to rethink how services can be re-designed to use technology in a way that best supports the needs of individuals whilst also helping them to meet their own strategic goals. It also presents a series of challenges, that must be addressed for the promise of digitally enabled approaches to be realised. Perhaps the greatest challenge is around how services and resources can be re-configured to take advantage of the potential of technology when applied alongside forms of support. The option of simply adding a digital care service onto existing services, as currently configured, is unlikely to result in the best possible outcomes but will add additional costs.

A previous article discussed the origins of technology-enabled care, focussing on telecare services and how they evolved to become a relatively stand-alone reactive alarm-based ‘safety-net’, centred around a monitoring service.

This article will present a brief overview of the current care technology landscape in the UK and discuss how it is changing in response to the shift to a digital infrastructure. It will lay the foundations for a series of three more in-depth articles that will address some of the key issues in more detail.

Generations of technology-enabled care

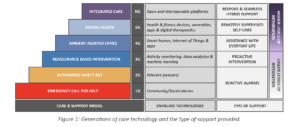

Technology-enabled care services (TECs) use technology to help support people to live independently in their own homes, in a supported or grouped living environment, or when out and about in the community. In the UK, the most established TEC service is telecare, which supports an estimated 1.7 million people. To date, there have been several generations of TEC, which were originally defined in 19961, and are extended here in Figure 1, to include fourth and next-generation (NG) approaches.

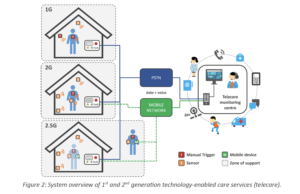

The first generation (1G) of technology-enabled care & support technologies are community or social alarm systems that were designed originally to support older people who lived in sheltered housing. It was extended to people who lived in dispersed housing using their landline telephone connection (i.e. the Public Switched Telephone Network – PSTN) and a 24-hour monitoring centre which could summon support in the event of emergency, using the system shown in Figure 2. This provided a means of calling for help in the event of an emergency using a pull cord or a wireless pendant that could be used to manually trigger an alarm. Basic environmental alarms were also available, such as smoke detectors, that could raise an alarm automatically.

A second generation (2G) added passive monitoring using smart sensors to remove one of the primary problems with 1G systems, namely that the user was not always able or willing to raise the alarm themselves, Figure 2. Sensors were introduced to automatically raise alarms and identify the cause of a wide range of emergency conditions including flood, heat, fall, enuresis, nocturnal epilepsy, external door left-open, and property exit alarms. Alarm hubs with built-in mobile connectivity were also introduced to support individuals without access to a landline telephone service. These systems are designed to support independent living and were later extended to support people when out and about using mobile devices that provided coverage for a reduced number of situations whilst outside of the home, often with GPS location monitoring capabilities (these can be thought of as 2.5G services). This extended provision offers a type of automated safety net for people who often live alone and who have been assessed as requiring additional levels of reassurance. Their focus on an alarm-based response means that they are primarily used for risk management, but they are still the predominant type of technology-enabled care in use in the UK today.

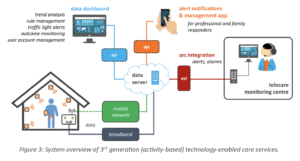

The third generation (3G) introduced a shift away from alarm-based monitoring and response to data-led, alert-based systems that can provide continuous monitoring of the home and of the activities and interactions of the person within the home. These data are used to generate simple behavioural, social and environmental trends that are used to help identify significant changes that can be a predictor of current or future problems. 3G systems therefore support the adoption of an intervention-based approach that may lead to the development of prevention-based services.

The core elements that make up a typical 3G system are shown in Figure 3. Sensors in the home transmit data wirelessly to a hub which uses a broadband or, more commonly, its own mobile data connection to upload it to a cloud-based server. From there it can be viewed using a data dashboard; rule-based alerts can be sent to a smartphone if there is an issue that requires an intervention or response (alert thresholds can be pre-determined and/or learned over time). In some cases, an alarm can be forwarded to a monitoring centre so that a call handler can respond and organise an appropriate response. These technologies are used for short-term assessment and reablement services, as well as for providing general reassurance to family carers and to family members who live a distance away. Activity monitoring is typically used in two modes of operation:

- Daily activity assessment – a means of establishing an individual’s behaviour over a period ranging from a few days up to several weeks to build-up a better picture of their daily routines and capabilities so that a package of care can be designed that best meets their needs, or to justify an existing level of support; and

- Safety reassurance – monitoring an individual’s behaviour constantly to keep track of how well they are coping with their everyday tasks, with the ability to notify a responder if there is a problem such as a sudden decline or change in the activities being performed.

An important distinction to note is that versions of these applications are often available for both health and care professionals and family members. This gives the latter the option of being able to use such technologies to co-ordinate support for a loved one, without the involvement of professional care services, should they so wish.

3G approaches also include basic health monitoring applications, sometimes referred to as telehealth. These are typically ‘stand-alone’ systems that allow people to monitor health conditions such as chronic obstructive pulmonary disease, heart failure, and type 2 diabetes. Measurements are performed periodically using a range of physiological sensors (e.g. a pulse oximeter or blood glucose monitor) at set times of the day. Values are monitored by a health professional with interventions triggered by significant changes. Video consultations may also be used to support individuals with their self-care.

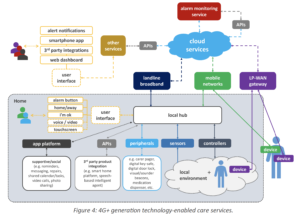

While 3G systems are primarily single-application solutions designed specifically for activity and environmental monitoring using ‘closed’ platforms, fourth Generation (4G) systems take advantage of consumer products and wireless connectivity standards to incorporate smart home capabilities and further extend support out of the home using wearables and apps. This allows them to offer additional features such as home automation, voice-based user interfaces, smart agents, location-based and context aware support, and 2-way video calling, as shown in Figure 4. Two-way video allows video calling with family and friends as well as with service providers, including a monitoring centre. It also supports remote consultations with healthcare providers e.g. a GP or other allied healthcare professionals. New IoT mobile connectivity technologies such as low-power wide area networks (LP-WANs) also provide a versatile alternative to traditional mobile networks – these will be discussed further in our next article.

Thus, 4G systems offer an extensible smart home platform that can finally support the goal of providing Ambient Assisted Living (AAL) – where intelligent technology is used to help people stay active for longer, remain socially connected, manage their own health conditions, and live independently in their own homes and communities. AAL re-defines the relationship between the individual and the technology – and the surrounding services – returning agency and choice back to them. As more features are supported, it lets them become a co-producer in the package of care, including technology, provided to help them using a needs-led, strengths-based approach. They also become a partner in the delivery of their care and support as an active beneficiary of the technology, rather than someone who is only in receipt of the technology ‘for their own safety’ or to provide reassurance to others.

Moreover, 4G approaches will often use mainstream consumer technologies, such as smart speakers, or an app running on a smartphone or tablet computer – or will be based on them – and thus will be familiar to all, reducing any stigma associated with their use. Occasionally, a bespoke device or service that is specifically designed to meet defined needs may be more appropriate. For example, a tablet device used for enabling communication that has a reduced feature set within a ‘walled-garden’ – providing a safe environment and limiting the scope for error. Sometimes a dedicated product might be a better option, e.g. one that offers a highly simplified user interface that mimics an object that is familiar to the user such as a simplified video calling and messaging product (e.g. Komp by No Isolation, Care Messenger, and Konnect by Just So Care). A characteristic of 4G systems is that they are often built using off-the-shelf consumer devices and ‘white label’ IoT platforms. The combination of mainstream consumer products and apps with specialist products for people who need additional levels of assistance allows technology to be used to support a wider range of people with varying abilities and needs. A brief overview of the care technology landscape in the UK

Fifth generation (5G) systems extend 4G capabilities with health applications including monitoring capabilities that use a combination of consumer health and fitness trackers and apps (e.g. Fitbit, Apple Watch) together with more specialist medical devices for more complex needs (e.g. Continuous glucose or blood pressure monitors). The use of apps to support self-care and mental health as well as for virtual consultations would also be integrated into 5G platforms. This is very different to the telehealth systems that were introduced over a decade ago that supported occasional periodical monitoring of a limited range of physiological parameters. It is the basis of virtual wards that allow “hospital at home” services which are currently being introduced for people with chronic lung and circulatory issues, as well as to enable early but safe discharge of older people from hospital with reablement support. If introduced appropriately it should improve the quality of life of users and provide considerable cost avoidance for the NHS.

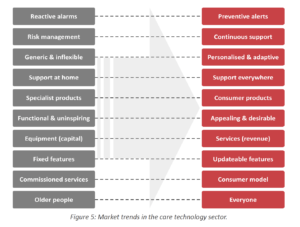

Figure 5 summarises these key market trends that are playing out across the care technology sector as it moves away from a reactive analogue model to a proactive digital one. Some of these changes are well underway, others are still on the early stages of the journey, and all four generations of technology-enabled care are currently in use to varying degrees across the UK.

Next-generation (NG) approaches offer improvements in machine-learning (ML) and the potential for future use of genuine artificial intelligence (AI) allowing support to be better matched to the changing needs and circumstances of the individual. The scope and quantity of data that will be available using 4G+ approaches will be significant ranging from room temperature to heart rate variability. It is likely that solutions from multiple vendors will be necessary to provide best-in-class solutions to meet a wide range of needs and circumstances. Moving forward, one of the major challenges of such systems will be the integration of data into a meaningful overview of an individual’s wellbeing within a unified platform. This is why NG approaches must introduce ‘interoperability at scale’ and move away from a focus on the technology to person-centred, knowledge-based outcomes. This requires technical, semantic, and organisational cooperation across multiple products and agencies leading to services that are built around, and which respond to, the needs of individuals. This will enable the co-production of tailored support and care packages that use, by design, a combination of people-based services and technology working in harmony, as appropriate to meet the desired outcomes of individuals.

Supplier landscape

The four generations of technology-enabled care described above are the pre-dominant models in use today, with most people benefitting from first- and second-generation systems. Third-generation activity monitoring systems have been available for many years, and 4G systems have also recently become available, but they are both struggling to dislodge the 1/2G alarm-based model currently dominant in the UK. Figure 6 shows the current supplier landscape for 1G and 2G TEC services in the UK.

This landscape consists of established telecare equipment suppliers who are heavily invested in the existing alarm-based model. Their focus is currently on shifting their customers onto digital alarm hubs to ensure compatibility with the new digital IP-based telecommunications network. Their alarm-based offer is essentially unchanged – at least with the first iterations of their digital alarm hubs, which essentially replicate the functionality of their analogue counterparts, with a few additional features that benefit mostly the service providers. Their primary aim is to manage the uncertainty associated with customers shifting from the legacy analogue platforms in widespread use to using equivalent digital platforms.

It may be observed that some suppliers operate at more than one level. They offer a vertical integration of supply which might present conflicts of interest if, for example, a supplier sells their own alarm hub and a monitoring platform, then they may be less likely or slower to adopt or support open standards that would provide a level playing field for all suppliers. Some are also, potentially, competing with their own customers if they also operate a monitoring service which is like those of their customers.

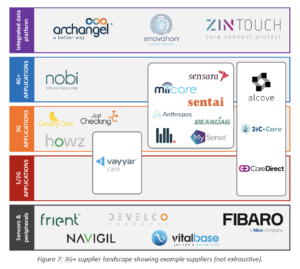

Alongside them, there are well-established suppliers that focus on 3G activity monitoring-based systems. Figure 7 shows the equivalent landscape for 3/4/NG services, none of which are exhaustive. Their focus tends to be on improving the data analytics capabilities of their platforms using algorithms and machine intelligence. There are also many new entrants who are looking at disrupting the market by developing 4G systems using customised ‘white label’ IoT platforms to produce ‘mix and match’ smart home solutions tailored to the care technology market. These incorporate sensors that are well suited to monitoring the home and interactions within it but offer less choice when it comes to care-specific applications.

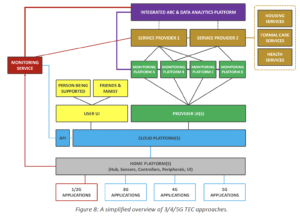

As with all aspects of digital monitoring, there are ethical and data privacy issues that need to be addressed as a sector, and when developing technology-based approaches with users. These providers are operating in what is a very competitive space and one where it is hard to break the existing alarm-focused model. This is due to commissioners being reluctant to depart fully from established service models, partly because of the disruption of doing so but also due to the immaturity of the technologies and lack of track records of the providers involved, relative to the established telecare sector. The other issue for commissioners is how to build a unified data model and analytics platform that can generate actionable insights and share records across systems from different providers – who will all be using their own proprietary coding standards and cloud-based services. For service providers that rely on monitoring solutions from more than one supplier, the ability to integrate these into a single platform, rather than operate multiple different applications is highly desirable, Figure 8.

A clear trend in the market is suppliers moving away from the process of selling ‘boxes’ to one of supporting required outcomes, with many extending their offer from being hardware only to that of selling features and providing services based on their platforms. This is mirrored in the way that commercial models are moving away from ones based on capital expenditure to subscription-based approaches. This could be a leasing model or one like how smartphones are financed with a separate contract for the hardware and data/service-based elements. This is driven partly by the need to charge a subscription fee to cover the costs of providing mobile connectivity and cloud services. Modern hubs also support continuous improvement with over-the-air upgrades, but this introduces the concept of long-term product stability and support. New features and protocols can be introduced onto existing platforms, as well as security updates, etc. However, it is not uncommon for new features to require improved hardware specifications, which can render relatively new products obsolete even though they are often still capable of supporting most of the required features.

Challenges and opportunities

With change comes many opportunities to re-imagine how technology can augment family and professional care and support to help people to live their life as they wish. It is a digital vision that many will articulate over the coming years.

However, there are also several challenges that must be overcome by the sector. Some aspects to consider include:

- Data – Which data are most relevant? Who owns it? Who controls access to it? How is data best visualised to give a snapshot of an individual’s wellbeing?

- Ethics – Who will ensure that services operate in the best interests of service users? How is consent for monitoring and sharing data obtained and renewed (or revoked)? Who assesses the capacity of people with mild cognitive impairment?

- Interoperability – Will the sector fully embrace the necessary open standards and protocols to enable true service integration? How will data from different providers be collated and presented to give a holistic overview of an individual’s wellbeing? Can a single platform be used to manage all digital care applications? What of an open standard for activity monitoring and other smart home applications?

- Equipment – what is the future for TEC hardware? Do alarm hubs still have a role? How do innovative designers and manufacturers play a role?

- Monitoring centre – How will its alarm-focussed role adapt to support new data-led services? What additional roles can it play? Will the model of large national centres have to give way to smaller, local and dispersed models? How will they serve NHS organisations, local authorities, housing providers and domiciliary care providers?

- Family carers – How will services and technologies help families to support their loved ones and provide reassurance that all is well (and notify them if it isn’t and what can be done about it)? How can they be better integrated with formal care services?

- Care services/providers – How can technology help manage scarce resources by providing timely assessment data and changes in circumstances? How can it help co-ordinate the best response based on need and ability to respond in time? How can care records be recorded and shared across all relevant stakeholders? How can the subjective views and observations of carers and family members be captured and included in the overall record and dashboard?

- Funding – How much will it cost? Who will pay for such services – what will the charging model be? Will it need different approaches for tenants, homeowners, and patients? Are people in the UK willing or able to pay an increasing proportion of their care costs?

- Awareness – how can all stakeholders be made more aware of the benefits and opportunities of using technology? Who should take responsibility for providing training to the public?

- Access – How will people make informed choices about what services and technologies are available and how to access them? How can post-code lotteries be avoided?

- Commissioners – What scope is there to influence the offer from suppliers? How can they shape the market? How will services need to be re-configured to make the best use of new digital technologies?

- Staff – What knowledge and skills are needed to support the shift to digital proactive services? How will the needs of individuals be assessed?

- Choices – how can individuals and their families codesign the care package that best suits them, and be made aware of the cost implications?

Conclusions

We live in exciting times – but this is a dual edged sword, as the opportunities offered by digital transformation will only be realised if services are designed to be needs-led and co-developed with all relevant stakeholders. This will require a re-configuration of how services are delivered to make the best use of data – with significant investment and change management needed. The question of how-to best support people to live the life they wish is the underlying issue here. How can this be achieved in a way that uses technology to augment people-based support to ensure that the right level of assistance is provided to the right individuals at the right time. These are some of the themes that we will be discussing in subsequent articles which we hope will help commissioners to understand how digitally augmented care and support services might look over the next 5 to 10 years.

Article written by T-Cubed

Sign up and keep up-to-date.

We'd love to keep you in the loop! Receive our latest news, events, insights, and blogs delivered straight to your inbox.